Canada FIN 319 2017-2026 free printable template

Show details

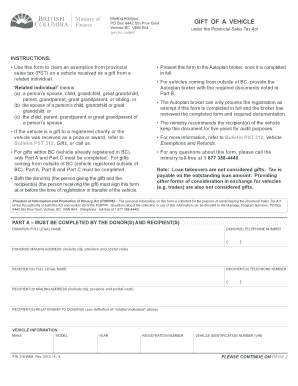

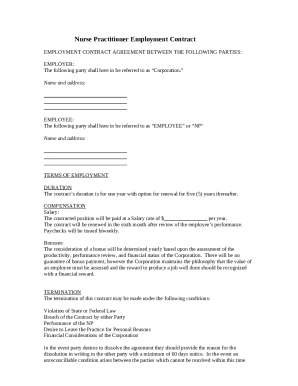

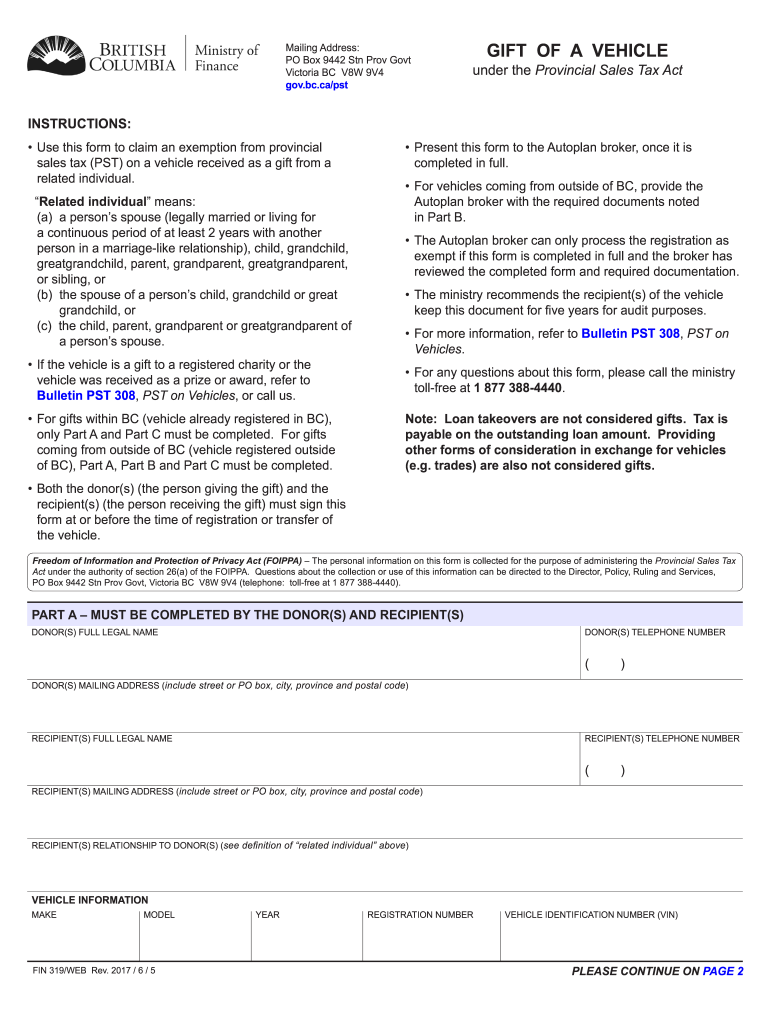

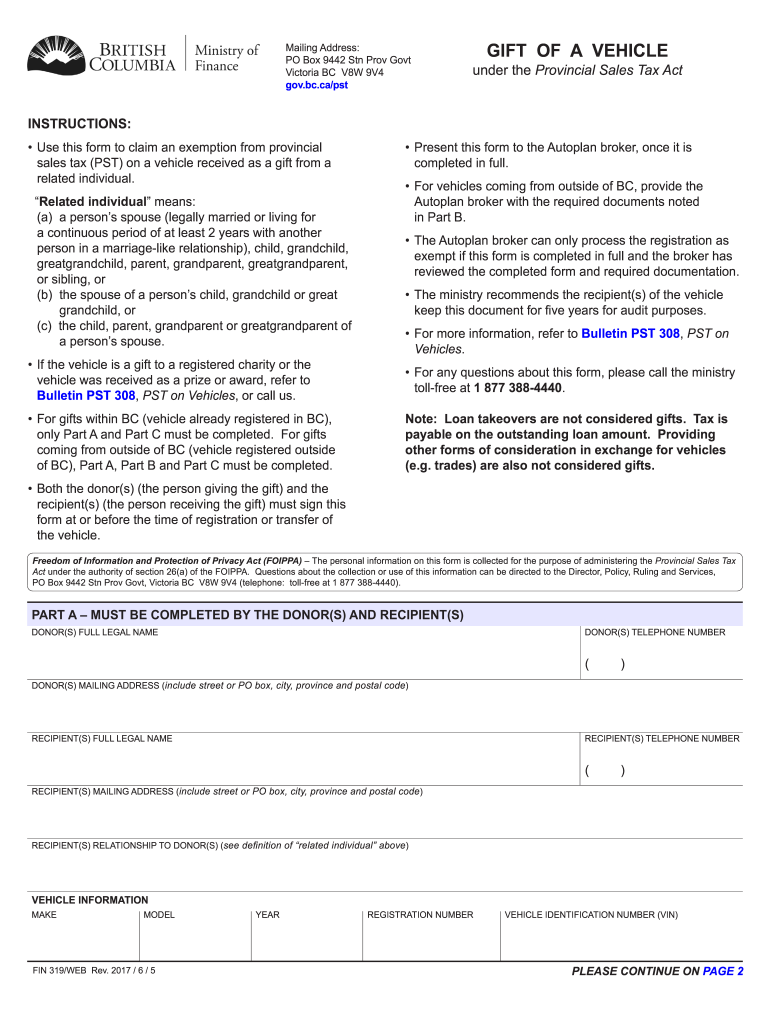

Este documento se utiliza para reclamar una exención del impuesto sobre las ventas provincial (PST) en un vehículo recibido como regalo de un individuo relacionado.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bc gift of a vehicle form

Edit your fin 319 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fin 319 gift of a vehicle form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fin319 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fin319 bc form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FIN 319 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out icbc gift letter form

How to fill out Canada FIN 319

01

Begin by downloading the Canada FIN 319 form from the official website.

02

Input your personal details including name, address, and contact information in the designated fields.

03

Fill in the section regarding your status in Canada and provide any relevant identification numbers.

04

Complete any financial information sections that apply to your situation, ensuring accuracy.

05

Review all entered information for completeness and correctness.

06

Sign and date the form at the bottom where indicated.

07

Submit the form via the specified submission method, either online or via mail, as directed.

Who needs Canada FIN 319?

01

Individuals applying for certain immigration benefits or status in Canada may need to fill out the Canada FIN 319 form.

02

Those required to report financial information to immigration authorities.

03

People seeking government services that require financial disclosure.

Fill

form vehicle bc

: Try Risk Free

People Also Ask about 319 fin

Can you gift a vehicle to a friend in BC?

Note: Only one gift of a specific vehicle between related individuals is eligible for exemption in a 12-month period. PST will apply to any future gifts of that vehicle within 12 months. The only exception is if a gift vehicle is gifted back from the recipient to the donor.

How do you transfer a car if the owner is not present?

Transfer of Ownership Form. (If the registered vehicle's owner does not appear in person, documents at serial No. 4,5 & 6 should be attested by Class-I officer. It is also mandatory to present the photocopy of CNIC and official phone number of the attesting officer)

How do I transfer my car to another person?

Required Documents Vehicle registration card. Copy of passport / Emirates ID of the resident. The sales contract. A copy of the customs statement.

How much does it cost to change ownership of a car?

What does Change of Ownership cost? R 150.00 Our Johannesburg Q4You fee. R 204.00 Licensing Department Registration Fee. R 72.00 Licensing Department Admin Fee. Annual License fee plus penalties if applicable (Use our calculator for this estimate) Full-Service turnaround time: 4 Days.

How to gift a car to someone in Canada?

Typically, you'll be expected to present some paperwork (e.g., form declaring the gift, proof of insurance, etc.) and your driver's license. If the recipient is required to pay a RST, it'll also be paid for during that process at your local DMV. Keep in mind some provinces may also require additional documentation.

How do I gift a car to a family member in Canada?

What documents are required a completed Sworn Statement for a Family Gift of a Used Motor Vehicle in the Province of Ontario form. proof of Ontario vehicle insurance. your Ontario driver's licence.

Can you gift a car to a family member in Canada?

You can transfer ownership of your vehicle to the following family members without requiring them to pay the retail sales tax ( RST ): spouse (including a common law spouse) parent or step-parent. grandparent or step-grandparent.

Can you change ownership of a vehicle online?

Many people now choose to record a vehicle change of ownership using the DVLA website. It's a quick and simple way to change the logbook online. The DVLA will send you an email confirmation and then a follow-up letter in the post to indicate that the changes have been made.

What is vehicle gift tax in BC?

Tax on privately acquired vehicles in B.C. The general PST rate on private vehicle sales and gifts of vehicles is 12%.

Can I gift a car to my brother in Canada?

You can't gift a car (or transfer ownership) unless you fully own it. So before you can think about gifting your car to a family member, you need to make sure you've paid off any remaining balance on your car loan.

Do you need a notary to gift a car in Ontario?

The Form 11573 Sworn Statement for Family Gift of Used Vehicle is a declaration that sets out the circumstances of the ownership transfer. The Sworn Statement must be signed by the donor and the recipient and notarized by a notary public or commissioner for taking affidavits.

Can you gift a used car to a friend in Ontario?

Can drivers give a car to a friend in Ontario? Yes, but the recipient will pay RST (retail sales tax). This is why gifting is more common amongst family members.

How do I transfer my car to a family member in Ontario?

Here's a list: A filled out Sworn Statement Form 1157E for Family Gift of Used Motor Vehicle. Motor vehicle insurance. Your driver's licence. Vehicle Ownership Permit. Safety Standards Certificate or Spousal Declaration. A completed Plate Transfer Declaration.

Can you gift a car to family in BC?

If you receive a vehicle as a gift you must pay PST on the fair market value of the vehicle, unless a specific exemption applies. If you receive a vehicle as a gift outside B.C. and bring or send the vehicle into the province, the PST is calculated based on the fair market value as of the date the vehicle enters B.C.

Is it better to sell or gift a car to a family member in Ontario?

The main benefit to gifting a car in Ontario to one of these family members is that the recipient isn't required to pay retail sales tax (RST) on the value of the vehicle. That means that you're effectively saving your family member the entire price of the car plus 13% of the purchase price that usually goes to RST.

How do I transfer a car in BC?

go to your local Autoplan broker to complete the transfer of ownership and update the registration, then license and insure it. before the vehicle can be registered in B.C., in most cases you'll need: the vehicle's current registration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in gift letter icbc without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your fin 319 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit gift of a vehicle bc on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute icbc gift form from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete gifting a vehicle in bc on an Android device?

Use the pdfFiller Android app to finish your transfer tax form icbc and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Canada FIN 319?

Canada FIN 319 is a form used by the Canada Revenue Agency (CRA) to report the income of foreign entities and individuals who have Canadian-sourced income.

Who is required to file Canada FIN 319?

Foreign entities and individuals who earn income from Canadian sources, such as businesses, rentals, or investments, are required to file Canada FIN 319.

How to fill out Canada FIN 319?

To fill out Canada FIN 319, you must provide personal information if you're an individual or details about your business if you're an entity, along with the specific income earned from Canadian sources and any applicable deductions.

What is the purpose of Canada FIN 319?

The purpose of Canada FIN 319 is to ensure transparency and accurate reporting of foreign income earned in Canada for tax compliance.

What information must be reported on Canada FIN 319?

The information that must be reported on Canada FIN 319 includes identification of the filer, nature of the income, amount of income earned in Canada, and details regarding any tax treaties applicable.

Fill out your Canada FIN 319 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Icbc Transfer Form is not the form you're looking for?Search for another form here.

Keywords relevant to icbc transfer tax form

Related to bc vehicle registration

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.